| Price (6/2/21) | $14.56 | Market Cap | $89.1 Million |

| Value | $18.20 | Net Debt | ($5 Million) |

| Target Price | $14.56 | EV | $84.1 Million |

Company Description

Where Food Comes From provides audit services and software for the agricultural industry. They verify production and quality claims that cannot be confirmed visually. Their primary customers are end-market providers and farmers who wish to convey their quality. Visit their website for a deeper understanding of their products & services.

Investment Thesis

- Where Food Comes From is positioned for compound growth with a significant moat in a growing industry.

- Due to its acquisition growth strategy, the company has shown strong free cash flow growth and effectively invests its cash flow while maintaining a solid balance sheet.

- Their ability to incorporate acquisitions effectively improves their margins and drives top-line growth.

- They can now use cash-on-hand and debt for future acquisitions, improving value on a per-share basis.

- The company’s positive impact on the environment and the sustainability of farming practices put the company in a position for long-term success.

Discussion

Value-Add & Required Products

The company’s services provide a clear value-add for their clients, displaying a higher quality that will allow them to charge more for their products. Other countries also require their services for agricultural products from the United States to access their markets, including China and Europe. Verification services also allowed farmers to move their animals to the front of the line for processing during the COVID crises. As capacity dropped, processors prioritized higher value products, like organically raised animals.

Dominant Position in a Growing Market

Where Food Comes From has shown an ability to win and hold onto customers. Its services are sticky since switching auditors has high switching costs. As a result, the firm succeeds with rule #1 of cost-effective sales growth: KEEP YOUR CURRENT (profitable) CUSTOMERS. Their acquisition strategy supports this goal by offering their current customers more services. More services allow the firm to reduce audit fatigue by providing audits for as many standards as possible at once. This strategy also drives increased revenue and improved margins per customer. Their increased revenue share in an industry growing at 15%+ should create a significant spike in revenue once they can resume in-person audits after COVID.

Generating Cash Flow

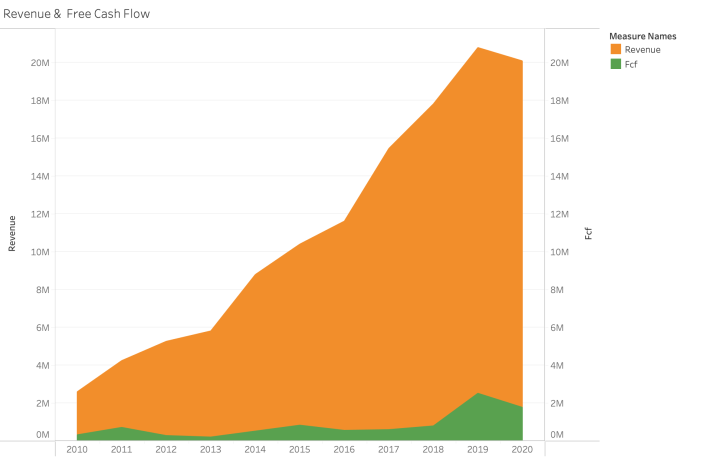

Their cash flow margins have improved significantly and appear to be on track to continue at these levels or improve as the company grows. The historical average EBIT Margin is 4%, but since Q2 of 2018 the company had an EBIT margin at or above that average. Their gross profit margin also increases with increased revenue since they have a significant portion of fixed costs in their COGS, shown with their revenue growth in the past few years. As a result, I expect the EBIT margin to remain at 10% or above going forward.

Investing Cash Flow

The managers have shown to be wise investors of capital, with clear acquisition criteria and valuation metrics. As a result, their acquisition strategy has led to a stronger position in the market and enterprise value creation that is beginning to compound. They have also deployed an effective open-market stock buyback plan that repurchased Where Food Comes From shares at an average cost per share of $7.86, or around 50% of the underlying value. Their return metrics have also been fantastic, with over 10% ROIC and ROE.

Strong Margins & Growth

The business has proven its operating model can scale profitably. They have experienced a 14% 5-year CAGR, and during that time, their free cash flow margin has increased from 5% to 13%. This growth should continue for some time and continue to strengthen their balance sheet.

Balance Sheet

Where Food Comes From has maintained a strong balance sheet with limited use of debt. Their cash and equity position will allow them to take advantage of quality acquisition opportunities when they arise.

People

John & Leann Saunders, CEO & COO, are a married couple who control 28% of the stock. They have proven to be effective operators for over 20 years. Their acquisitions became more focused in 2012. Since then, they have targeted and integrated multiple firms successfully.

John has indicated a renewed shareholder orientation by making statements focused on protecting the per-share value of equity. Including no longer using equity for acquisitions and repurchasing stock on the open market.

CEO & COO Salary: Reasonable compensation structures that indicate a positive shareholder orientation.

Downside Risk

| A poor acquisition could destroy its Free Cash Flow and balance sheet due to its size. The owners were not as disciplined about their acquisition strategy before 2012. The future expected growth of the company could outgrow the management team’s skill set. They have proven their ability to scale the business to this point, but scaling at 20%+ rates for a $20 million revenue business is different than growing at 15% rates for a $5 million business. However, Leann Saunders’ experience managing large divisions within large companies provides the management team some track record with large companies. |

Upside Potential

- Their Software Segment is tiny with flat sales but increasing EBITDA, with an EBITDA of $240k in 2020. This segment could grow significantly over time with increasing margins.

- COVID suppressed revenue significantly due to the lack of in-person audits. A return to normal levels should release significant pent-up demand.

- The company expanded and improved its desk audit services during COVID, which have much higher margins. Expanding these services further could open new markets and customers who could not afford their full services.

- The continued focus of the world on sustainable farming practices could drive even greater growth than projected.

Environmental & Social Impact

Where Food Comes From’s focus on driving sustainable farming practices addresses key risks to our society and environment. Their work allows farmers to receive the full value of sustainable practices that are better for the earth and the animals they care for and incentivizes more farmers to switch to those practices. There is no doubt that there is an alignment between the success of the company and the future sustainability of our environment and food supply.

Indicators or Events to Track

- Regulation changes have been discussed for a while around required tracking for animals in the US. If the progress on those requirements continues and turns into law, it would create even more growth.

- Tracking gross profit margins and SG&A expense growth as revenue increases. Gross profit margins should improve as revenue increases, and the SG&A expenses should grow significantly slower than revenue. Otherwise, it could indicate the management team is not executing its growth strategy well.

Valuation Discussion

- Includes two similar public companies, SGS is a mature direct competitor based in Europe & Transcat is similar.

- I expect multiples to contract from the current level to direct competitors’ averages.

- DCF models are conservative, maintaining current margins and lower than projected revenue.

- Key Assumptions:

- Discount Rate: 15%

- Investment Exit Period: Q4 2024

- Revenue Growth: 15% in 2021 & 2022, 10% in 2023 & 2024, 5% thereafter

- Competitor WQS Acquired by QIMA in 2019, the numbers are not publicly disclosed.

Target Price

- Target Price of $14.56, Where Food Comes From is a strong buy below that price.

- 80% Price to Value used for the target price.

- Based on the company’s strong cash flows, market position, and balance sheet.

- These historical numbers indicate quality management that has improved over time.

- Their balance sheet also reduces risk by being able to absorb a few, albeit small, mistakes.

Worth $1?

Was this post worth $1? Tim would love to have it! So contribute $1 here to help fund the blog.

$1.00